Lets Go! If you want to know more about liquidity pools and how to create a solana liquidity pools, this post is for you! In this post we are going to show you how liquidity pools works and also how you can easily create your own pool using our liquidity Pool Creator.

Liquidity Pool Creator is a easy to use tool created by Thecoder , that make the process of creating a liquidy pool easy, fast and really cheap. With just Some clicks you will be able to create and manage your liquidity pool using tool.

Solana Liquidity Pools enable seamless token trading, price stability, and market growth on DEXs like Raydium and Orca. Must have How to create Solana Liquidity Pools – Complete Guide, where you’ll learn how to pair your token with SOL or USDC, provide liquidity, earn passive income from trading fees, and enhance your token’s adoption in the DeFi ecosystem.

What is a Solana Liquidity Pools?

A Solana Liquidity Pool is a decentralized pool of tokens that allows users to swap assets automatically on DEXs like Raydium and Orca. Instead of setting prices manually, the price is determined by the ratio of tokens in the pool. Liquidity providers deposit SOL or USDC alongside their token, enabling smooth trading, reducing slippage, and earning fees from every transaction

How a Solana Liquidity Pools Works?

If you’ve just created a token, you need a way for people to actually buy and sell it. Without a liquidity pool, your token just exists—it has no real market. That’s where our Liquidity Pool Creator comes in. It makes the whole process easy, fast, and cheap, so you don’t have to worry about complicated setups.

Why You Need a Liquidity Pool

When you create a liquidity pool, you’re basically putting up an initial supply of your token and SOL. This allows anyone to swap between them instantly. The more people trade, the more active your market becomes. Plus, every time someone trades, you earn a small fee. That means you’re not just making your token tradeable—you’re also generating passive income.

How It Works

- Add your token and some SOL to the pool.

- The pool lets people swap your token instantly.

- When people buy, the price goes up. When they sell, the price adjusts.

- You earn fees from every transaction.

That’s it. No complicated setups, no middlemen—just a simple way to make your token tradeable and start building a real market around it

STEP BY STEP – How To Create Solana Liquidity pools

- Start the Liquidity Pool Creator App.

- Connect and fund your wallet with 0.3 SOL and tokens.

- Set up trading pairs and allocate token amounts.

- Mint the ownership NFT for your liquidity pool.

- Manage your pool and start earning trading fees.

How To Create Solana Liquidity pools

Total Time: 4 minutes

1. Start The Liquidity Pool creator App

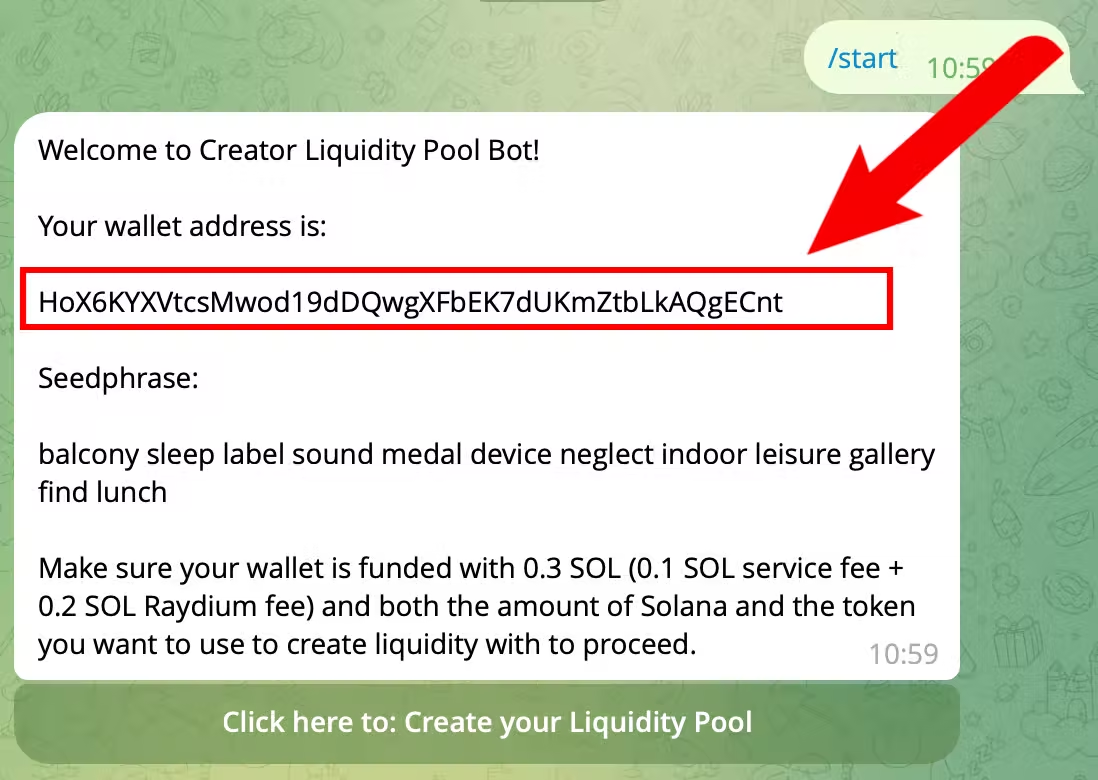

The firts thing you need to do is to launch our Solana Liquidity Pools Creator , this will open your telegram account where you will need to start the TOOL–> /start

2. Start Fund the wallet

The first thing you need to do after strating the aplication is to sent 0.3 Solanas (0.1 Service fee + 0.2 SOL radydium fee). Also the amount of the pair you want to add to your liquidity pool (solanas)+(your Desired token) .

What you need: 0.3 Solanas total to transaction fees [0.1 For our service + 0.2 For raydium Fees]. The amount the Pair you want to add of Solanas + Desired token

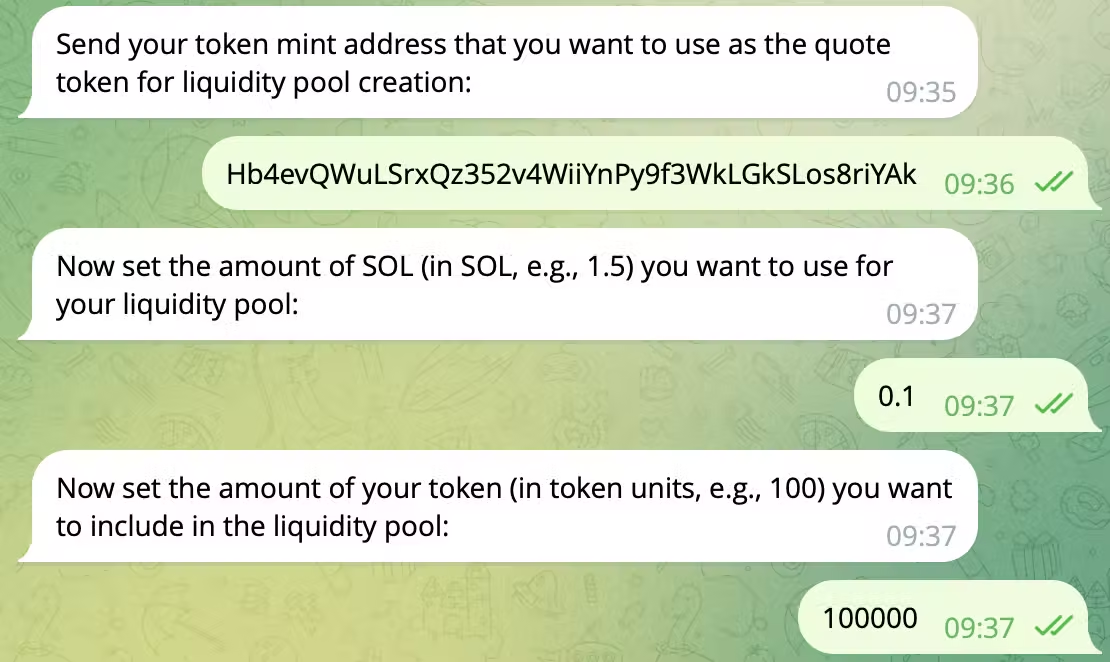

3. Set the Trading pairs

With your wallet fundend, now is time to set your liquidity pool.

1. First send your token (contract address)

2. Set the amount of Solanas you want to be added on your pool

3. Set The amount of your desired Token you want to add to the pool.

Perfect ! Now you just need to wait for the confirmation!

4.Mint the ownership +NFt of the pool

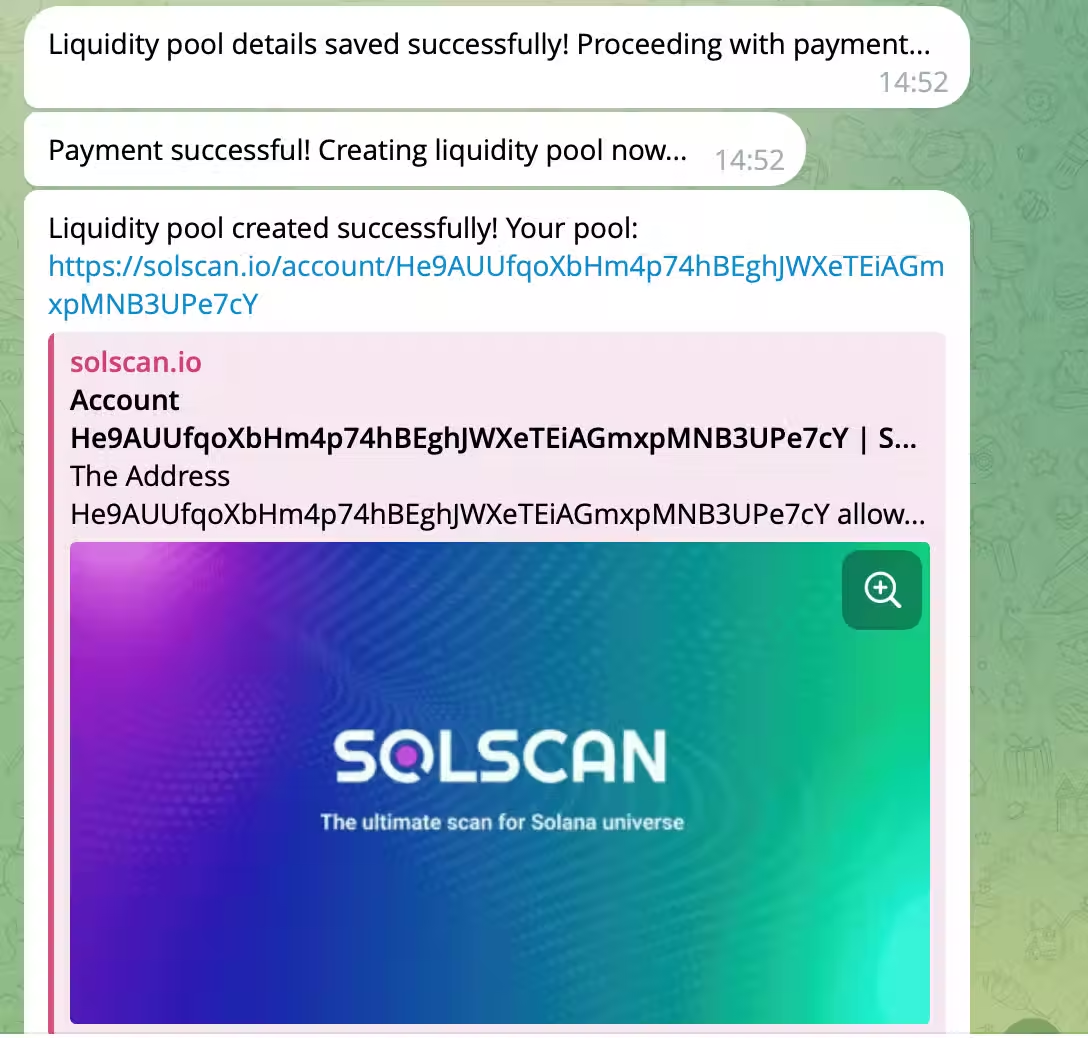

The next step is automatic, you don’t need to do anything else! Just wait and your liquidity pool will be created. If You face any problem Feel free to contact us. [email protected].

In this step you will recieve the confirmation that your pool was successfully created + the smart contract link to confirm that your pool was correcly created.

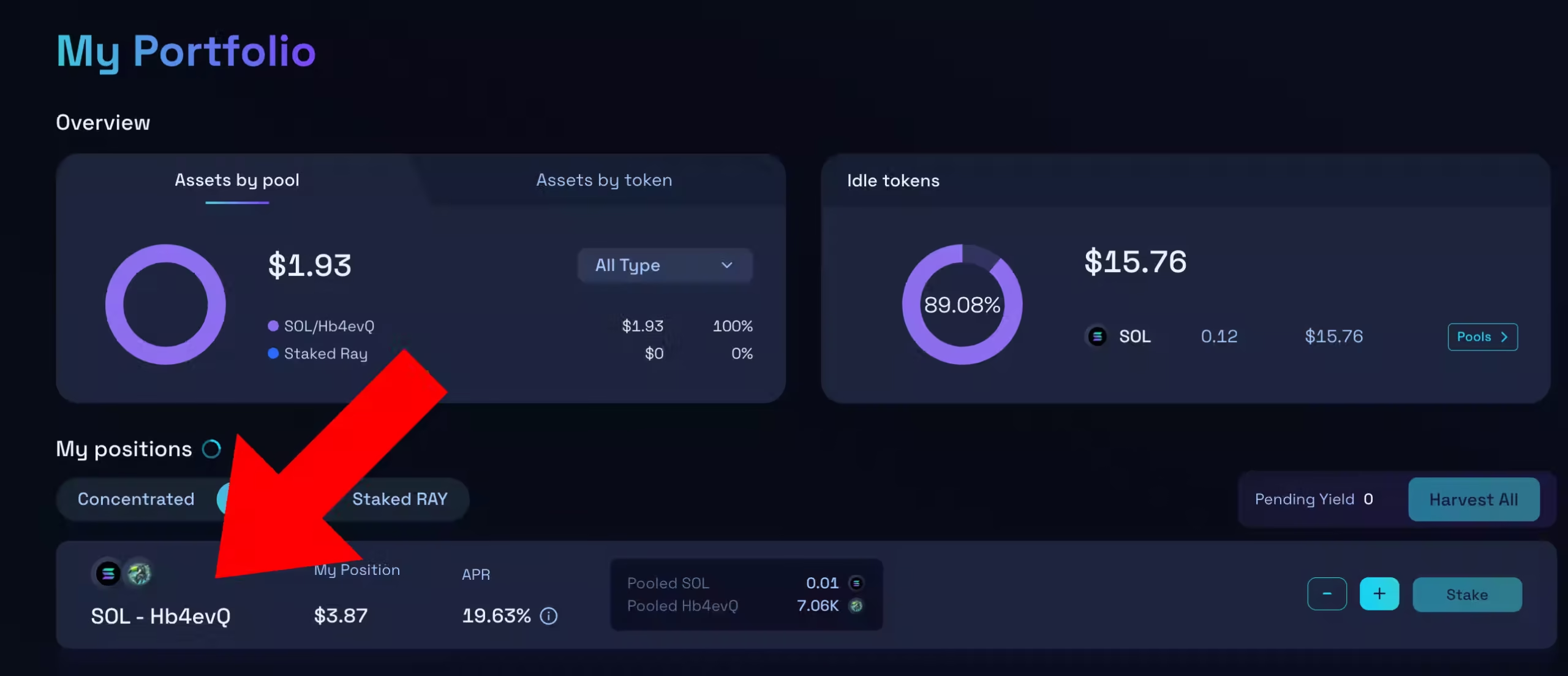

5. Manage Your Pool – Recieve Fees

Now that your pool is created , you can manage your assets in raydium solana. All your tokens provided to the pool are now avaible to the world! Now people can buy and sell your token in any plataform (just as in Phatom).

What to do now ?

Now that you’ve successfully created your liquidity pool, your token is officially tradable. However, your work isn’t done yet. Here are the next crucial steps to ensure your token gains traction and attracts traders:

- Test Your Pool – Visit Raydium or Jupiter and perform a swap to ensure that everything is working correctly. Check if transactions go through smoothly and that the price updates as expected.

- Share Your Trading Link – Your token won’t gain traction if no one knows about it. Share the direct swap link with your community, post it on your social media channels, and engage with potential buyers.

- List Your Token on Jupiter – Jupiter is the largest DEX aggregator on Solana, meaning it helps traders find the best swap routes. Listing your token there increases visibility and trading volume.

- Promote Your Token – Building a community is key to a successful token. Start marketing efforts on Twitter, Telegram, Discord, and other platforms where crypto traders and investors are active.

- Monitor Liquidity and Adjust as Needed – Keep an eye on your liquidity pool and ensure there is enough depth to support smooth trading. If needed, you can add more liquidity to prevent price slippage and improve trading efficiency.

- Encourage Holders and Utility – A token without a use case or active holders will struggle. Consider introducing incentives, staking rewards, or community-driven projects to keep users engaged and interested.

By following these steps, you’ll not only make your token tradable but also set it up for long-term success. Now is the time to focus on growth, community engagement, and liquidity management to maximize your token’s potential.

List Best Liquidity Pools

| Liquidity Pool | Pros | Cons |

|---|---|---|

| Raydium | – Deep Liquidity – High trading volume and efficient swaps. – Order Book Integration – Connects with OpenBook for better price execution. – Yield Farming – Earn extra rewards for providing liquidity. | – Impermanent Loss – Risk of loss due to price fluctuations. – Complex Setup – Requires knowledge of AMMs and order books. |

| Orca | – User-Friendly – Simple interface, great for beginners. – Low Fees – Efficient swaps with minimal transaction costs. – Concentrated Liquidity – Better capital efficiency for liquidity providers. | – Lower Liquidity than Raydium – May have higher slippage on some pairs. – Limited Trading Features – Lacks advanced tools like order book integration. |

| Saber | – Stablecoin Focused – Optimized for low-slippage swaps between stable assets. – Cross-Chain Support – Bridges assets from other blockchains. | – Limited Token Support – Mostly for stablecoin pairs. – Less Volatility, Lower Returns – Not ideal for high-risk, high-reward strategies. |

FAQ – Solana Liquidity Pools

How does pricing work in Solana Liquidity Pools without setting a manual price?

Solana Liquidity Pools work differently from traditional markets—there’s no need to set a token price manually. Instead, the price is determined by the ratio of the base token (your token) to the quote token (SOL or USDC) in the pool. As users buy and sell, this ratio changes, automatically adjusting the price based on supply and demand. This system ensures fair price discovery and continuous liquidity without needing an order book.

How a Solana Liquidity Pools Works?

A Solana Liquidity Pool is a decentralized way to enable instant token trading without the need for buyers and sellers to match orders. Instead of setting a fixed price, the pool automatically balances the token ratio, adjusting the price based on supply and demand. Users who add liquidity by depositing SOL or USDC with their token help facilitate trading and earn a percentage of the transaction fees as rewards.

What is Thecoder Tools ?

TheCoder Tools is an all-in-one Web3 platform designed to simplify token creation, trading automation, and blockchain management. With no-code solutions, users can launch Solana and Ethereum tokens, manage liquidity, and automate trading in minutes. Our tools ensure security, efficiency, and affordability, making blockchain technology accessible to everyone, from beginners to advanced users.

Is Thecoder Tools Sercure?

Yes, TheCoder Tools is secure. We use pre-audited smart contracts to ensure all tokens are created safely, without vulnerabilities. Since users own 100% of their token supply, there are no hidden controls or restrictions. Transactions are processed directly on the blockchain, ensuring full transparency. Additionally, we do not store private keys or user funds, keeping your assets safe.

How to see liquidity pool of a coin

To see the liquidity pool of a Solana coin, follow these steps:

1. Go to a Solana DEX – Visit Raydium (raydium.io) or Orca (orca.so), which host liquidity pools.

2. Search for the Token – Enter the token’s contract address or symbol in the search bar.

3.View Pool Details – Click on the liquidity pool to see total liquidity, token reserves, trading volume, and fees earned.

You can also check Solscan (solscan.io) by searching for the token and navigating to the Liquidity section to view existing pools.

How to remove liquidity from a Solana liquidity pool?

To remove liquidity, go to the DEX where you added liquidity (e.g., Raydium or Orca), navigate to the Liquidity section, and find your token pair. Select Remove Liquidity, choose the percentage to withdraw, confirm the transaction, and receive your tokens back along with earned fees.

How do I check the price impact in a Solana liquidity pool?

When swapping tokens on a DEX, the price impact is displayed before confirming the trade. This impact depends on pool size and trade volume—small pools experience higher price fluctuations. Larger liquidity pools reduce slippage, ensuring more stable pricing for trades.

Can I create a liquidity pool for any Solana token?

Yes! As long as your token is minted on the Solana blockchain, you can create a liquidity pool on Raydium, Orca, or another Solana-based DEX. Pair your token with SOL or USDC, provide initial liquidity, and start enabling decentralized trading for your project.

Do liquidity providers earn passive income?

Yes! Liquidity providers earn a percentage of trading fees collected from every swap in the pool. These rewards accumulate over time, providing passive income based on trade volume and pool participation. The more liquidity you provide, the greater your share of the fees.